Find your way through Credit Card and Debt Trap

Sat 20 Jan 2024

The history of credit card is interesting. What started as Charge Plates (Metal Plates), an instrument to purchase on credit in the early 20th century where the plates were often kept at the store, and the customer’s information and credit limit were maintained manually.

Today the same has evolved to a metallic card allowing for online and contactless payments.

In these 100 years, the span of credit card industry has reached from few hundreds to 1.25 billion users as of 2023 and most likely to grow at the exponential rate year on year.

Interesting facts about wallets

Its very interesting to know, the wallet you are carrying now in your pocket was introduced in early 1950s when credit cards had become prevalent and multi-pocketed wallets were made to incorporate them. Previous to that wallets were larger in size to accommodate money and smoking paraphernalia.

Credit Limit Owners or Slaves

Today, you will find more number of credit cards in the available slots than the debit cards. Credit card gets introduced at a very early stage as soon as you get your job, you become eligible for one. The banks are lowering their eligibility criteria to ensure their CIF (Card In Force) is increased and occupies highest market ratio. Every salaried and non -salaried have more than one card.

Basis the eligibility the credit card limit is assigned and the card owner feels empowered to use this limit as if its his own money. In actuality you are using banks money only to be repaid on time without interest or delayed with interest.

This mentality of ownership of the limit has made the owner a slave where using the card without any repayment liability on mind takes over rational decisions when you are out shopping.

The use and abuse of the financial instrument

Its observed the new owners of credit card are transactors, ie they purchase and pay in full as per their bill cycle. Once they get used to being a transactor, they increase their spending prowess and slowly start spending on goods they would not have purchased in cash. These purchases once out of budget gets converted into Easy instalments.

EMI option is usually provided to all customers to trap them into using the card continuously and banks earn from the interest and charges income. Look around, your mobile, TV, insurance premium, flat rent, monthly grocery purchases, clothes all are purchased from credit cards. The ease of purchase makes you forget that the means of payment are limited.

The cards have an option to pay Minimum Amount Due, for example if you are billed 10000, you can pay 1000, it’s a very gullible method of earning upto or above 35% interest that bank will charge on the unpaid principal.

This whole process took me 30 minutes to write and 3 minutes for you to read, believe me its engulfed thousands of hours of people who are stressed on how to pay the debt accrued on the credit cards.

You might be thoroughly lucky and smart to not have fallen into the debt trap that cards have brought into lives of millions.

Getting out of the debt trap

Many of us have seen the movie Confessions of a Shopaholic. In the movie what Isla Fisher did might not apply to us, she dipped all her credit cards in ice trays and froze them with water. Instead, lets try simple techniques

- Pay in cash and decrease dependency on card.

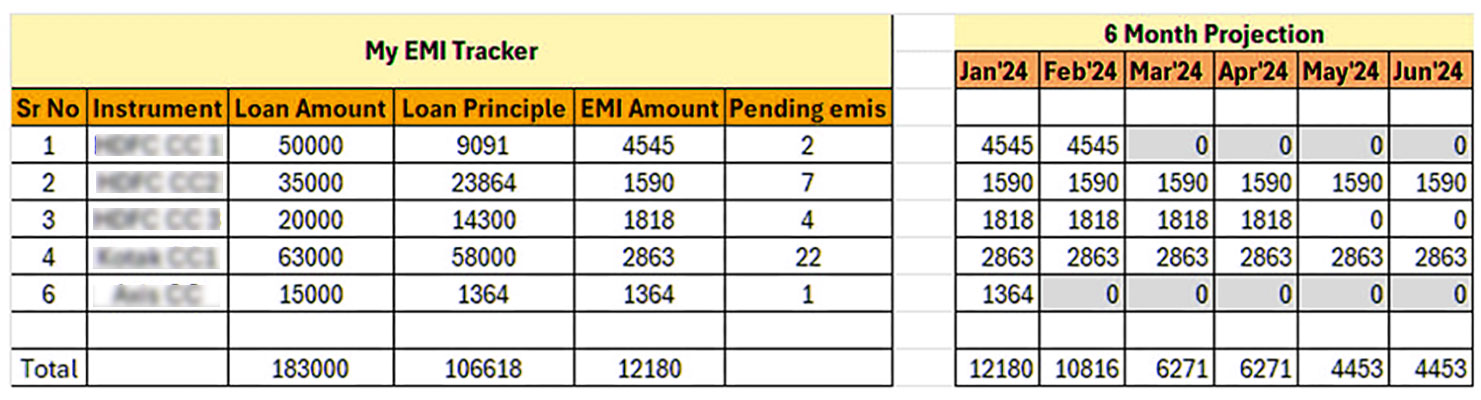

- Keeping a track of your spends in excel or apps will help. When you write the emis and principal outstanding of loans, it plays at the back of mind when you try to make an unwarranted purchase.

- Create a loan tracker, with dates or emi, principle outstanding and pending numbers of EMIS. This simple excel will keep you in check regarding the outstandings and will help you evaluate your paying capacity

- If you have multiple loans, foreclose all, by going for only 1 loan for a longer tenure. This will reduce the monthly burden. Do this only with a promise made to yourself that this would be the last one. Else it will keep on circling.

- Study the reward point structure in detail and remember we use credit card to buy things with and not to get reward points. At times we are seen spending to increase the reward point, weird but true in some cases. The reward point structure is extremely non lucrative if you calculate how much you are spending to earn the X number of points to grab the gift that comes with XXX points.

Rest, you are your own best instructor. If you are eligible enough to own a card, own the debt, you need to take ownership of repayment

Important fact, which is not backed by data, but is true, in developing countries like India there are many instances of over-debt in youngsters who finally end their lives or live a life of depression, they were not helped out, not because nobody wanted to, but people around them, their families themselves are not equipped or financially well off to repay for them. Help is very limited.

Share this article with someone you care and needs to read this.

Also, when you read this, and if in position try helping someone who is struck by the debt trap without being judgemental.

Credit Card Debt Trap Credit Card Debt Trap Credit Card Debt Trap

Disclaimer: All views and opinions expressed in The Brew Opinion – our opinion section – are those of the authors and do not necessarily reflect the official policy or position of TheBrewNews.com, the company, or any of its members.

Apr 29 2024

Apr 29 2024